By Insurance Forums Staff

July 13, 2022

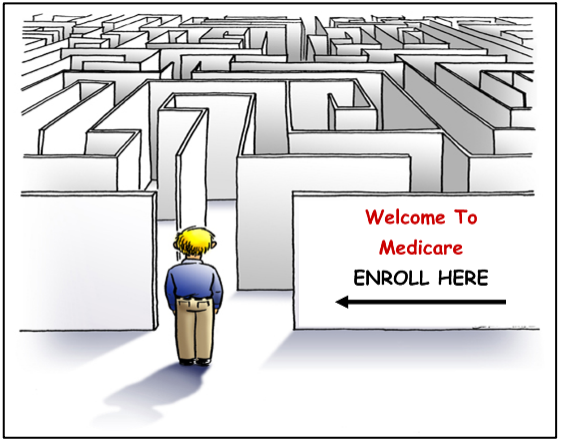

Seniors enrolling in Medicare face a process fraught with challenges, display significant gaps in knowledge of plan components, are overwhelmed by Medicare advertisements, and often fail to re-evaluate their plan options when selecting plans. As a result, many are enrolling in plans that fail to best reflect and support their evolving healthcare needs.

These challenges could jeopardize the ability of seniors to make the best choices for their unique health and wellness needs, and the results may worsen as they get older.

These are the findings of a new report, Hidden Crisis: The Medicare Enrollment Maze, issued today by national healthcare consultancy Sage Growth Partners. The report is based on a survey of 1,142 individuals ages 64 and older, which was commissioned by Healthpilot, an AI-driven, fully digital platform for Medicare education and insurance enrollment.

The report explores the profound impact of widespread confusion and overwhelming enrollment challenges on older Americans, as well as the entire healthcare system. With nearly 64 million Americans enrolling in Medicare in 2021 and the U.S. Census Bureau projecting more than 73 million Americans will enroll by 2030, the negative effects will only intensify.

“This report shows the striking level of confusion surrounding Medicare enrollment for all ages. While there may be many better plan options, very few enrollees have the necessary knowledge to choose them,” said Dan D’Orazio, Sage Growth Partners CEO. “The level of satisfaction with shopping for Medicare plans lies below the cellar-dwellers of industry satisfaction such as cable tv providers and internet shopping. This is very troubling considering what is at stake for older adults and their clinical and financial health.”

Among the report’s key findings:

- Only 20% of Medicare-eligible individuals have a good understanding of Original Medicare; only 31% have a good understanding of Medicare Advantage.

- 63% are “overwhelmed” by Medicare advertising; only 31% of respondents “strongly agree” that they can make effective selection decisions.

- More than half (58%) stay in their current Medicare plan each year rather than reviewing their plan options and enrolling in the best plan for their evolving needs.

- 33% have a financial advisor, but only 2% use that advisor to help with plan selection.

“This report confirms that most older adults find Medicare enrollment confusing and lack adequate resources or support to choose the best plan,” said Dave Francis, CEO of Healthpilot. “Enrolling in Medicare is a pivotal time for millions and the Medicare marketplace is ripe for transformation. I believe that it is possible to make health care better for individuals aged 64 and older throughout the country, but we need dynamic platforms and sincere actions to make this happen.”

In April, Healthpilot commissioned Sage Growth Partners to conduct an independent survey of Medicare enrollment-eligible individuals (those aged 64 and older). More than 80% of survey participants had coverage through Medicare or Medicare Advantage. The respondents came from across the enrollment experience spectrum:

- 10% of respondents were first-time enrollees

- 32% had been enrolled for less than one year to three years

- 35% for 4-9 years

- 23% for 10 years or more.

The full report, Hidden Crisis: The Medicare Enrollment Maze, can be found here.

Greg Says agrees that there is a critical need for better education among the Medicare-eligible population. The surest way to avoid the anxiety associated with navigating the bewildering assortment of plans and options is to seek the assistance of a local licensed independent Medicare advisor. These agents have no allegiance to any specific insurance carrier but are focused on what is best for the individual based on a thorough understanding of that individual’s needs and preferences.