The cost of investment schemes, impostor scams and other fraud is skyrocketing

By Christina Ianzito, AARP

February 28, 2023

Consumers reported losing almost $8.8 billion to scams and fraud in 2022, up 30 percent over 2021’s losses, according to newly released numbers from the Federal Trade Commission (FTC). The rising cost of these crimes is staggering, considering that in 2020 Americans lost only $3.5 billion to fraud, including identity theft.

It’s “overwhelming,” said Attorney General Merrick B. Garland, 70, during a Feb. 9 interview with AARP at the Department of Justice (DOJ) about what the federal government is doing to fight fraud — which is often aimed at older adults. He said that while the DOJ is dedicated to the effort, it’s challenged by the fact that these crimes are “innovative and constantly changing.”

And while the number of scam reports last year was actually down — to 2.4 million, from 2.9 million in 2021 — individual victims lost far more than ever before: In 2022, the median loss from fraud was $650, up from $500 in 2021. Some scams proved much more lucrative for criminals than others, according to these new numbers, which are based on reports submitted to the FTC’s Consumer Sentinel Network directly by consumers, or through law enforcement and other organizations.

The most costly fraud

The highest losses were incurred through investment scams — a total of more than $3.8 billion, double the amount lost to such schemes in 2021, with a staggeringly high median loss of $7,144 per victim.

Impostor scams (sometimes called impersonator scams) also exacted a high toll on their victims, who reported $2.6 billion in losses last year (a median loss of $995 per person). These extremely common scams take many different forms but essentially involve a criminal posing as someone you’d trust in order to steal your money. They often will pretend to be a representative from a government agency who’s contacting you regarding Social Security, Medicare or your taxes; or a family member (as in the grandparent scam); celebrity; debt collector; or utility company representative.

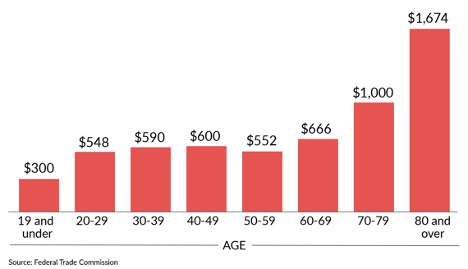

Median Fraud Loss By Age, 2022

Of the 2.4 million scam reports submitted last year, impostor scams were most common, followed by online shopping scams; scams involving prizes, sweepstakes and lotteries; investment scams; and business and job opportunity scams (the “Fraudulent Five,” as the FTC puts it).

While a smaller percentage of older people report being victims of scams than younger people, they tend to lose far more money to these crimes: A median amount of more than $1,000 for victims 70 and older, compared with about $550 for those in their 20s.

These numbers, unfortunately, may only reveal a fraction of actual losses to fraud, which is notoriously underreported because victims may feel ashamed or doubt that authorities can help them. But reporting scams is crucial, experts say, allowing law enforcement to target its efforts and helping to reveal the full scope of the problem. (See below for information on where to report these crimes.)

Other report highlights

- There were over 1.1 million reports of identity theft last year; about 442,000 were related to credit card fraud.

- Individual victims within the military community (veterans, military members and their spouses) of all ages also continue to report losing more money than their civilian counterparts, with a median loss of $765 in 2022, compared with $650 among the general population.

- Texts were the most common contact method criminals used for scams (22 percent), followed by phone calls (20 percent) and emails (19 percent).

- There were almost 40,000 reports of romance scams in 2022, with a total loss of $546 million.

- Among those who reported losing money to a scam, the biggest losses were through bank transfers ($1.5 billion) and cryptocurrency ($1.4 billion).

Where to report fraud

If you spot or have been victim of a scam, report it to the Federal Trade Commission (FTC) at reportfraud.ftc.gov and the Federal Bureau of Investigation’s Internet Crime Complaint Center at IC3.gov. The more information they have, the better they can identify patterns, link cases and ultimately catch the criminals.

The AARP Fraud Watch Network Helpline, 877-908-3360, is free resource; call to speak with trained fraud specialists who provide support and guidance on what to do next and how to avoid scams in the future. The AARP Fraud Watch Network also offers online group support sessions.